There are no items in your cart

Add More

Add More

| Item Details | Price | ||

|---|---|---|---|

Rupee Cost Averaging (RCA) helps investors lower their average cost per unit by investing consistently across market cycles. Learn how it works and why it’s core to SIP success.

17/06/2025

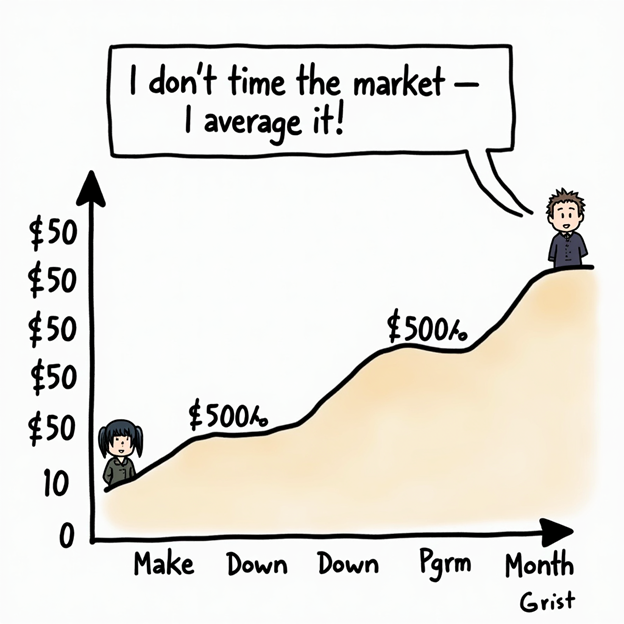

One of the greatest secrets behind SIP success is Rupee Cost Averaging (RCA) — a strategy where you invest a fixed amount at regular intervals, no matter where the market is.

This results in buying more when prices are low, and less when prices are high — automatically averaging your cost over time.

How Does Rupee Cost Averaging Work?

Let’s say you invest ₹5,000 every month in a mutual fund. Here's what might happen:

| Month | NAV (₹) | Units Bought |

| Jan | 50 | 100 |

| Feb | 40 | 125 |

| Mar | 60 | 83.3 |

📉 Outcome: Lower average purchase price, reducing market timing risk.

Real-Life Example: Deepak’s Goal Planning Deepak started a SIP in 2020 for his daughter’s education goal in 2035.

✅ Helps avoid emotional investing

✅ Works in volatile and uncertain markets

Conclusion

You don’t need to time the market if you master Rupee Cost Averaging. It’s how smart investors build wealth — automatically.

Stick to your SIPs. Let RCA silently reduce your cost and increase your returns over time. Summary Table: Rupee Cost Averaging Explained

| Scenario | Market Trend | Average NAV Paid | Outcome |

| Volatile Market | Up and Down | Lower than average price | More units, better returns |

| Constant SIP Investment | Any condition | Auto-adjusted | Reduces timing risk |

| Lump Sum vs RCA | Uncertain times | Lump sum at one NAV | SIP with RCA fares better in volatile markets |

Dr. Satish Vadapalli

Research Analyst