There are no items in your cart

Add More

Add More

| Item Details | Price | ||

|---|---|---|---|

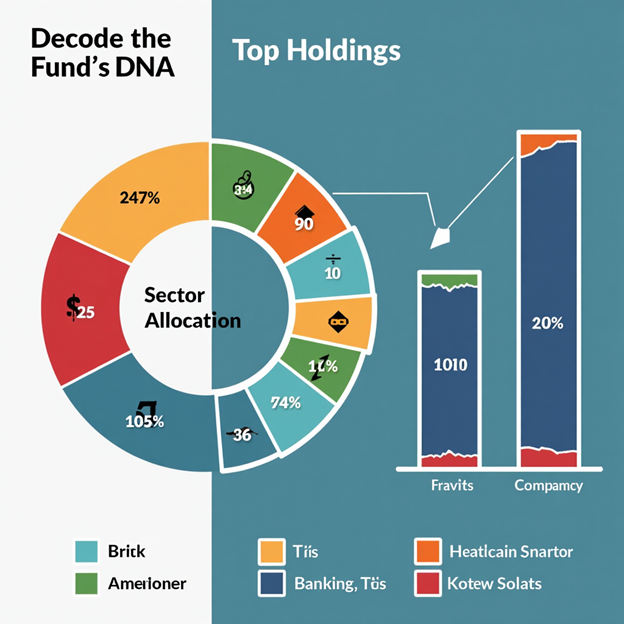

Knowing a fund’s top holdings and sector exposure helps you understand where your money is really going. Here’s how to read this section of a fund factsheet.

09/06/2025

When you invest in a mutual fund, you own parts of many companies — but do you know which ones? The Top Holdings and Sector Allocation tell you exactly that.

In this post, we break down these key sections and show how they can help you evaluate risk, diversification, and style — with a real-life example.

What Are Top Holdings & Sector Allocation?

✅ Why It Matters

Real-Life Example: Aditi vs. Ravi

Conclusion

Top holdings and sector data help you look under the hood of your mutual fund. Don’t just chase returns — understand what drives them.

Review your fund factsheet today. Are you diversified enough? Talk to your advisor if you’re too concentrated.

Summary Table: Sector Allocation Insights

| Metric | What It Tells You | Ideal Scenario |

| Top 5 Holdings > 40% | High concentration risk | Prefer <30% |

| One Sector > 35% | Sector bias | Balanced sector mix |

| International Exposure | Global diversification | Useful for USD hedge |

| Cyclical Bias | Sensitive to market cycles | Monitor during volatility |

Dr. Satish Vadapalli

Research Analyst