There are no items in your cart

Add More

Add More

| Item Details | Price | ||

|---|---|---|---|

Introduction

Losing a job can create financial anxiety. One of the first thoughts that strike investors is — “Should I pause my SIPs?” While it may seem like a quick relief, the long-term consequences of stopping your SIPs during market lows can be costly.

In this post, we explore how to make smart SIP decisions during tough times, with a real-life example of Arjun and Suma, who faced a similar crossroad.

23/06/2025

SIP (Systematic Investment Plan) works best when markets are volatile — which often coincides with economic stress (like job loss).

Stopping SIP = Missing market lows

Missing market lows = Lower long-term gains

Continuing SIP = Rupee cost averaging benefit

Pausing SIP briefly is okay, but restarting soon is critical

Before you pause, evaluate:

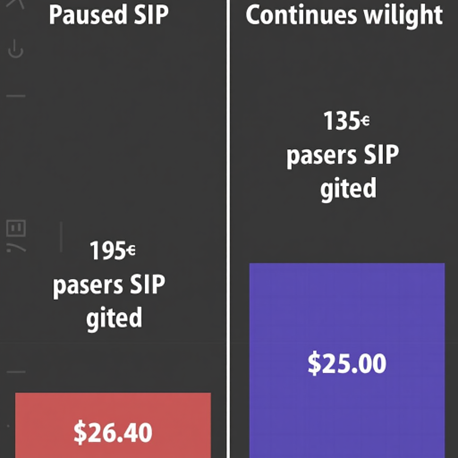

Real-Life Example: Arjun vs Suma Both lost their jobs in April 2020.

| Insight | Explanation |

|---|---|

| Prioritize goal-based SIPs | Don't pause critical ones (retirement, child education) |

| Use emergency funds smartly | That's what they're for — to avoid breaking long-term investments |

| Pause luxury-oriented SIPs | These are okay to delay temporarily |

| Resume SIPs ASAP post-recovery | The longer you wait, the more gains you lose |

Conclusion

Pausing SIPs may offer temporary relief but can hurt long-term compounding. Be selective — not reactive. If you have an emergency fund, lean on it and stay invested in key goals. Don’t let short-term loss cause long-term regret.

Lost a job? Make a financial priority list. Pause optional SIPs, protect core goals, and lean on your emergency fund. Resume SIPs as soon as you can — the future you will thank you.

Summary Table: SIPs During Job Loss

| Investor Action | Avg. Return (3-5 Yr CAGR) | Avg. Risk (Volatility) | Avg. Investor Behaviour |

|---|---|---|---|

| Continued essential SIPs | 10% - 12% | Medium | Goal-focused, disciplined |

| Paused all SIPs | 4% - 6% | Low | Fear-based, weak recovery |

| Selective SIP pausing | 8% - 10% | Medium-Low | Balanced, uses emergency fund wisely |

Dr. Satish Vadapalli

Research Analyst