There are no items in your cart

Add More

Add More

| Item Details | Price | ||

|---|---|---|---|

Before 2017, mutual fund investors faced a maze — multiple funds with similar names and overlapping strategies. This made fund selection confusing and portfolio duplication common.

To fix this, the Securities and Exchange Board of India (SEBI) introduced Fund Categorization Rules to simplify how funds are named and structured. These rules brought uniformity, transparency, and comparability, helping investors make informed decisions.

01/06/2025

In this blog, we break down the five broad fund categories, explain how they work, and show how this reform made investing easier — with a relatable real-life example.

What Are SEBI’s Fund Categorization Rules?

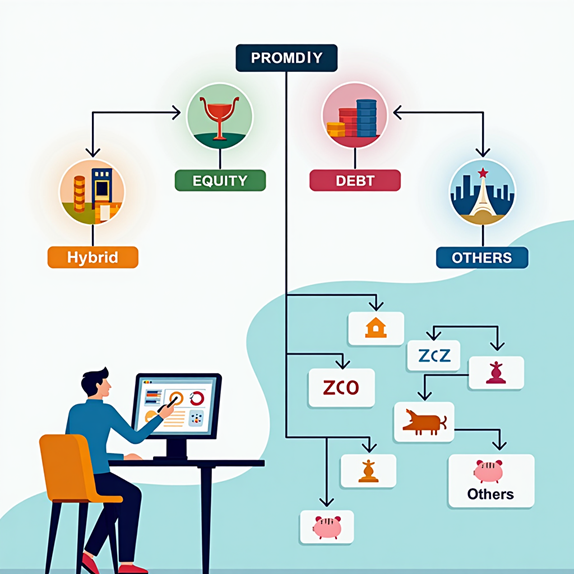

SEBI mandates that each mutual fund scheme fits clearly into one of the five categories:

Real-Life Example: Kavya Cleans Her Portfolio Kavya, a 30-year-old IT professional, held 9 mutual funds, many of which were labeled “balanced,” “equity-oriented,” or “growth.” Post-SEBI rules:

Why These Rules Matter to Investors

✅ No overlap – One scheme per sub-category

✅ Standard definitions – Clear understanding of fund risk/return

✅ Better comparison – Apples-to-apples evaluationConclusion

SEBI’s categorization rules were a game-changer. Investors now have clarity and control. By understanding these five buckets, you can better align funds with your goals, risk appetite, and time horizon — and avoid the clutter of unnecessary or confusing schemes.

🧾 Review your current funds — do they fit into these SEBI-defined buckets?

📊 Talk to your advisor about portfolio overlap and duplication.

🎯 Use SEBI’s clarity to align investments with life goals.

| Category | Common Subtypes | Avg Return (5 Yr CAGR) | Avg Risk (Volatility) | Avg Investor Behaviour |

|---|---|---|---|---|

| Equity Funds | Large Cap, Mid Cap, Flexi Cap, ELSS | 10% – 14% | High | Long-term focused, prefers SIPs |

| Debt Funds | Liquid, Corporate Bond, Short Duration | 5% – 7% | Low to Medium | Safety-seeking, conservative investing |

| Hybrid Funds | Aggressive Hybrid, Balanced Advantage | 8% – 11% | Medium | Moderate investors seeking balance |

| Solution-Oriented | Retirement Fund, Children’s Education Fund | 7% – 9% | Medium | Goal-based, long lock-in, SIP investors |

| Other Funds | Index Funds, ETFs, Fund of Funds | 9% – 12% | Market-dependent |

Dr.Satish Vadapalli

Research Analyst