There are no items in your cart

Add More

Add More

| Item Details | Price | ||

|---|---|---|---|

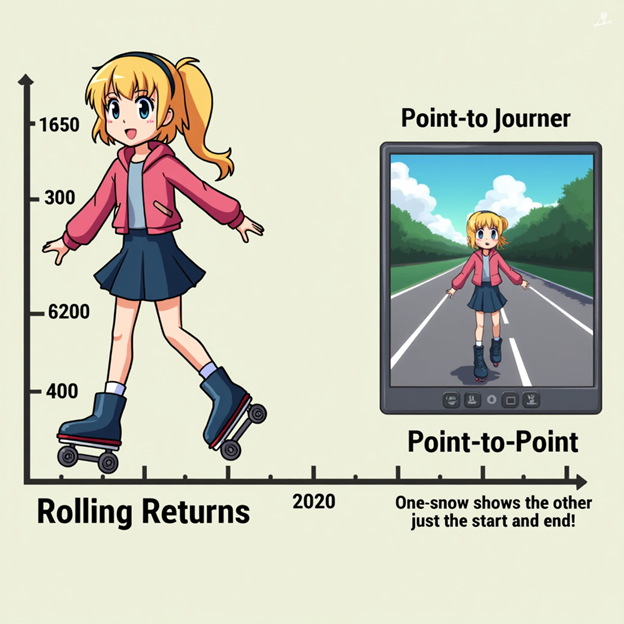

Learn the key difference between Rolling Returns and Point-to-Point Returns in mutual funds. See how rolling returns offer a clearer, more reliable picture of fund performance.

22/06/2025

Most investors look at one-time returns to judge a mutual fund. But what if you’re catching a good year or a bad year by chance?

That’s why seasoned investors prefer Rolling Returns — they give you a fuller picture of how a fund performs in different market cycles.

Point-to-Point Returns – Snapshot View

This measures performance from one date to another.

🧮 Example: Jan 1, 2019 to Jan 1, 2024 = 11% CAGR

🟥 Problem? One-off events or timing luck can distort the picture.

Rolling Returns – Moving Window View

Rolling returns measure performance over multiple overlapping periods.

🧮 Example: 3-year rolling returns calculated daily from 2015–2024

✅ Shows consistency

✅ Filters out luck or bad timingReal-Life Example: Nisha vs Arjun

Conclusion

Point-to-point returns can mislead by focusing on a cherry-picked period. Rolling returns, on the other hand, reveal the real picture of fund performance across time.

When comparing funds, always look at 3-year or 5-year rolling returns. It’s a smarter, safer way to judge consistency.

Summary Table: Returns Comparison

| Type | What It Shows | Pros | Cons |

| Point-to-Point | One fixed period return | Easy to understand | Can mislead due to timing bias |

| Rolling Returns | Multiple overlapping periods | Shows consistency & stability | Slightly more technical to interpret |

Dr. Satish Vadapalli

Research Analyst