There are no items in your cart

Add More

Add More

| Item Details | Price | ||

|---|---|---|---|

The Riskometer on your mutual fund factsheet isn't just a label — it reflects the fund's true risk. Here’s how to read it and use it in your investment decisions.

10/06/2025

" Ever noticed the color-coded dial on your mutual fund factsheet? That’s the Riskometer, a SEBI-mandated tool that shows how risky your fund is. But many investors either ignore it or misinterpret it.

In this post, we decode the Riskometer — what the labels mean, how it’s calculated, and what it means for your investment goals.

What Is the Riskometer?

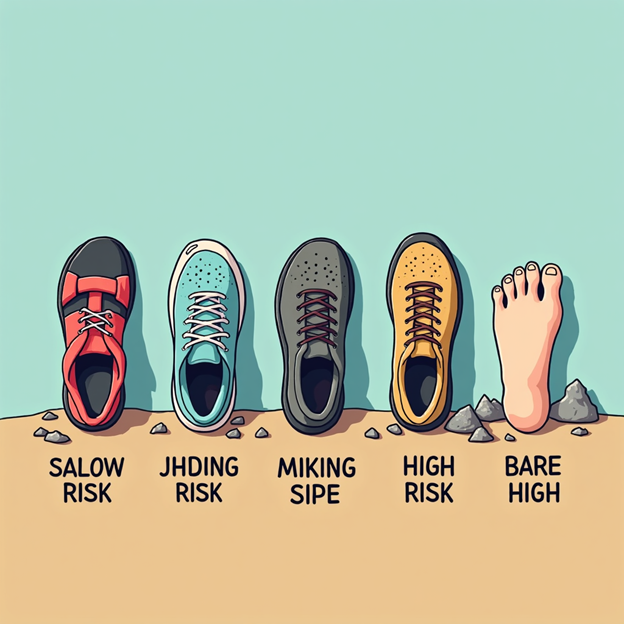

The Riskometer classifies a mutual fund into six risk categories:

✅ Why It Matters

Conclusion

The Riskometer is your first filter — it tells you if the fund’s temperament suits yours. Ignore it, and you might invest in a fund that makes you lose sleep.

Don’t just see the return chart. Look at the Riskometer. Let it guide your choices based on age, goals, and risk tolerance.

Summary Table: Riskometer Breakdown

| Risk Level | Typical Fund Types | Suitable For | Expected Volatility |

| Low | Liquid, Overnight Funds | Ultra-conservative investors | <1% |

| Moderate | Hybrid Conservative, Short Debt | Income-seeking retirees | 2–4% |

| High | Equity, Sectoral, Mid/Small-Cap | Aggressive long-term investors | 12–18% |

| Very High | Thematic, Micro-Cap | Speculative growth seekers | 20%+ |

Dr. Satish Vadapalli

Research Analyst