There are no items in your cart

Add More

Add More

| Item Details | Price | ||

|---|---|---|---|

Introduction

Retirement is not an age. It’s a financial goal.

Whether you plan to retire at 60 or 50, what matters is how financially prepared you are to maintain your lifestyle after your pay checks stop.

Mutual funds offer a flexible, goal-based, and inflation-beating solution for long-term retirement planning. Let's understand how — through a real story of Rakesh and his retirement journey.

16/06/2025

Long-Term Growth: Equity mutual funds can offer higher returns than traditional pension schemes or FDs over 15–30 years.

SIP Discipline: Systematic Investment Plans (SIPs) automate investing and reduce the risk of market timing.

Diversification: Mutual funds spread risk across multiple assets.

Tax Efficiency: Equity funds offer long-term capital gains benefits.

Real-Life Example: Rakesh’s Retirement Plan

Rakesh, 30, started a SIP of ₹5,000/month in an equity mutual fund. He increased it by 10% annually as his income grew. By the time he turned 60:

· He had invested around ₹45 lakhs

· His corpus grew to ₹1.6 crore (at 11% CAGR) In contrast, his colleague Anil started at 45 with ₹10,000/month. By 60, he had only ₹36 lakhs.

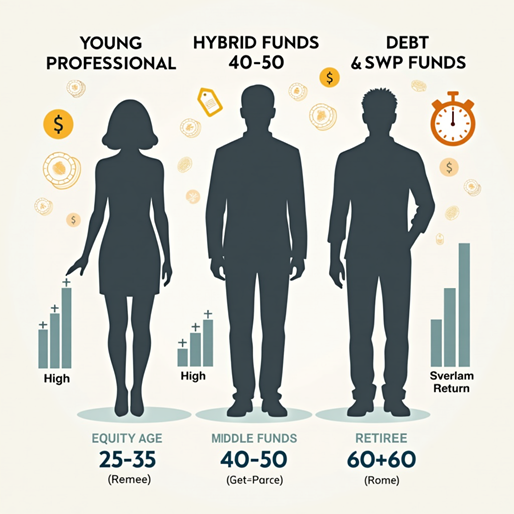

· In your 20s–30s: Focus on Equity Mutual Funds (Flexi Cap, Index Funds)

· In your 40s–50s: Gradually shift to Hybrid and Conservative Hybrid Funds

· Post-60: Move to Debt Funds or SWPs (Systematic Withdrawal Plans)

Key Takeaways

| Stage | Ideal Fund Type | Why It Works |

|---|---|---|

| Early Career | Equity Mutual Funds | High growth potential |

| Mid Career | Hybrid/Asset Allocation Funds | Balance of growth & safety |

| Retirement Age | SWPs/Debt Mutual Funds | Stability + controlled withdrawals |

Conclusion

Don’t just save for retirement. Invest with a goal and a timeline. Mutual funds offer the ideal vehicle to ride inflation, grow wealth, and retire peacefully. The earlier you start, the more freedom you buy for your future self.

Start your retirement SIP today — even if it’s just ₹1,000/month. Let compounding work its magic and secure your tomorrow, today.

Summary Table: Retirement Planning via Mutual Funds

| Age Group | Avg. Return (10-20 Yr CAGR) | Avg. Risk | Avg. Investor Behaviour |

|---|---|---|---|

| 25-40 (Equity) |

10% – 12% | High | Consistent SIPs, long horizon focus |

| 40-55 (Hybrid) |

8% – 10% | Medium | Moderate equity, goal realignment |

| 55+ (Debt/SWP) |

6% – 8% | Low | Conservative, income-focused |

Dr. Satish Vadapalli

Research Analyst