There are no items in your cart

Add More

Add More

| Item Details | Price | ||

|---|---|---|---|

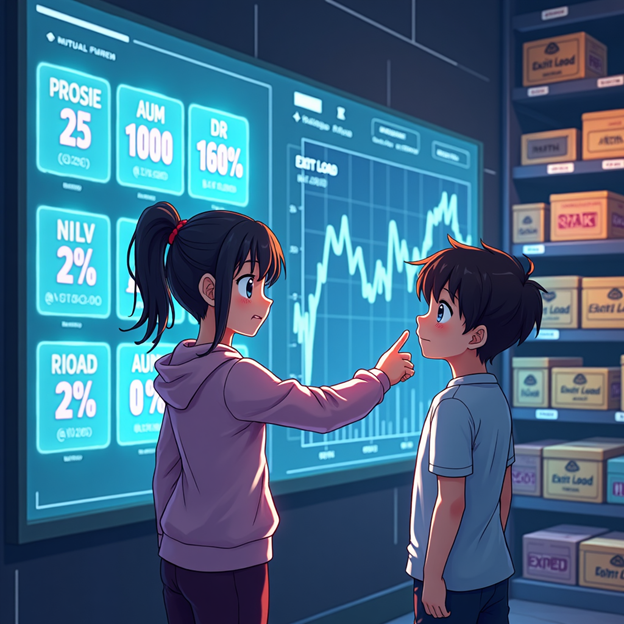

Learn the three key mutual fund metrics—NAV, AUM, and Exit Load—that impact your investment returns and decisions. Master these basics to make smarter investing choices.

06/06/2025

When you invest in mutual funds, it’s easy to get distracted by fancy names and glossy brochures. But success lies in understanding the three simple numbers that can silently affect your returns: NAV, AUM, and Exit Load.

These aren’t just technical terms — they shape how much you invest, what you earn, and when you should exit. Let’s break them down in plain English.

NAV – Net Asset Value

NAV is the price per unit of a mutual fund. It’s calculated as:

(Total value of fund’s assets – liabilities) / total units outstanding

📉 When the fund’s investments fall, NAV drops.

📈 When markets rise, NAV increases.

💡 Myth buster: A low NAV doesn't mean it's cheaper — returns depend on percentage growth, not the absolute NAV.

2. AUM – Assets Under Management

This is the total money a mutual fund is managing. For example, if 1 lakh investors each invest ₹10,000, the AUM is ₹1,000 crore.

📊 High AUM = trust + popularity

⚠️ But too large an AUM may reduce agility in small-cap or mid-cap funds.

3. Exit Load – The Early Exit Penalty

An exit load is a small fee (usually 1%) if you redeem units before a certain period (typically 12 months).

🚪 Designed to discourage short-term trading

💰 Affects net returns if you exit too soon

Real-Life Example: Tara’s NAV Trap

Tara chose a fund with ₹10 NAV thinking it was “cheap.” Her friend Reema picked a fund with ₹80 NAV.

After 1 year, both funds grew by 10%.Conclusion

Mastering these 3 metrics — NAV, AUM, and Exit Load — makes you an informed investor. They influence when and what you invest in, and how long you stay. Ignore them, and you may end up losing money even in a rising market.

Check the NAV, AUM, and exit load before investing. Ask your advisor how these affect your fund’s suitability — and plan your holding period accordingly.

Summary Table: NAV, AUM & Exit Load

| Metric | What It Means | Why It Matters | Common Misunderstanding |

| NAV | Price per fund unit | Determines how many units you get | “Low NAV is cheaper” – Not true |

| AUM | Total fund size | Indicates fund popularity and scale | “Bigger AUM is always better” |

| Exit Load | Fee for early exit | Impacts returns if exited before lock-in | “Exit load is always zero” – It’s not |

VS FINTECH

A California-based travel writer, lover of food, oceans, and nature.