There are no items in your cart

Add More

Add More

| Item Details | Price | ||

|---|---|---|---|

Introduction

Market crashes are scary, but they’re not new. The way mutual funds and investors behave during these downturns reveals critical lessons. By studying past events like the 2008 Global Financial Crisis or the 2020 COVID-19 crash, we understand what worked, what failed, and how to navigate future shocks. In this blog, we decode mutual fund behavior during crashes and how two investors — Raj and Meena — made very different decisions during the 2020 meltdown.

10/06/2025

Mutual funds do not panic — investors do.

Actively managed funds often rebalance during crashes, shifting to safer sectors or increasing cash.

Balanced Advantage Funds (BAFs) automatically adjust equity-debt allocation based on market conditions — reducing equity when markets are high and increasing when they're low.

Index funds passively follow the market and ride the entire wave — up and down.

Funds follow strategy. The outcome depends on investor behavior, not just market events.

Real-Life Example: Raj vs Meena (2020 Crash)

| Insight | Explanation |

|---|---|

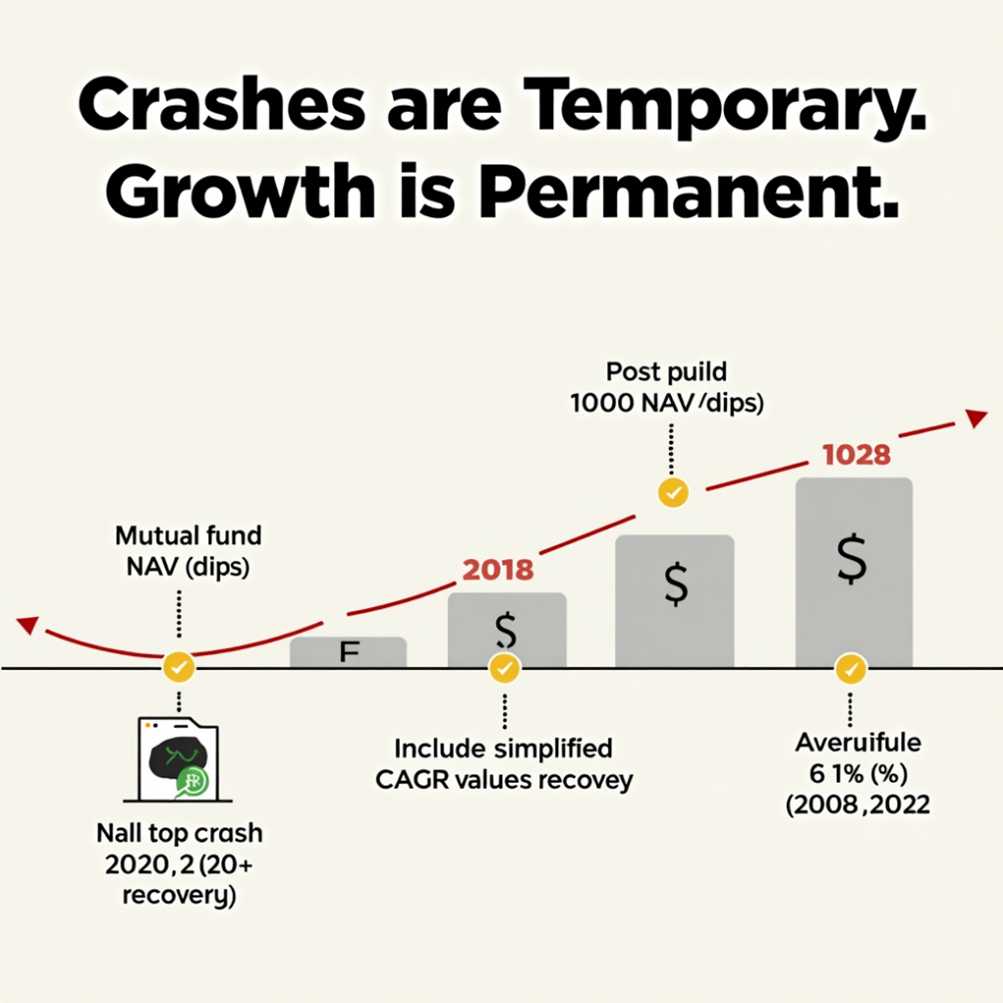

| Crashes are temporary | Every crash in history has been followed by recovery |

| Fund strategy matters | Dynamic and diversified funds reduce damage |

| Investor behavior matters more | Staying invested through crashes often leads to better outcomes |

| Timing the recovery is hard | By the time news is positive, markets have already rebounded |

Conclusion

Crashes test investors more than investments. Mutual funds are structured to survive — sometimes even thrive — during downturns. What matters most is your response, not the event. Learn from history, and don't repeat panic-driven mistakes.

Build a crash-proof mindset. Choose funds with solid rebalancing strategies and stick to your plan during turbulence. SIPs, asset allocation, and patience win in the long run.

Dr. Satish Vadapalli

Research Analyst