There are no items in your cart

Add More

Add More

| Item Details | Price | ||

|---|---|---|---|

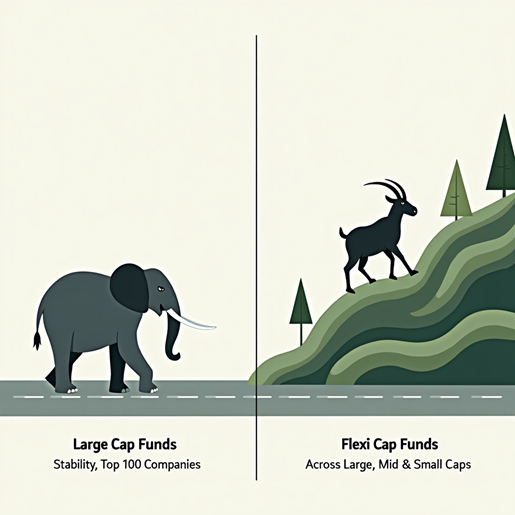

Confused between Large Cap and Flexi Cap mutual funds? Discover how they differ in structure, risk, return potential, and investor suitability — with a real-life example

02/06/2025

Introduction

If you’ve ever tried choosing between a Large Cap Fund and a Flexi Cap Fund, you’ve likely wondered: “Aren’t they both equity funds? What’s the big deal?” Well, while both invest in the stock market, their mandates, flexibility, and risk-return profiles are quite different — and knowing the difference can help you pick the fund that suits your goals and risk appetite. In this blog, we simplify the difference between these two equity categories using SEBI definitions, a real-world example, and a quick comparison table.

How to Choose Between Them?

| ✅ If You Want... | 🔄 Choose... |

| Stability + Blue-chip focus | Large Cap Fund |

| Flexibility + Higher Upside | Flexi Cap Fund |

| Lower downside in corrections | Large Cap Fund |

| Adaptive strategy | Flexi Cap Fund |

Conclusion :

There’s no one-size-fits-all winner here. Large Cap Funds offer consistency and lower risk, while Flexi Cap Funds chase higher returns with freedom to adapt. Choosing between them depends on your age, financial goals, and comfort with volatility.

🧾 Review your portfolio — is it overexposed to one market cap

🎯 Add the right mix of large and flexi cap funds to match your risk and goals.

💬 Talk to your advisor before rebalancing.

| Fund Type | Avg Return (5 Yr CAGR) | Avg Risk (Volatility) | Avg Investor Behaviour |

|---|---|---|---|

| Large Cap Fund | 9% – 11% | Low to Medium | Stable SIPs, long-term mindset |

| Flexi Cap Fund | 11% – 13% | Medium to High | Return-chasing, moderate panic exits |

| Pure Mid Cap | 12% – 15% | High | Volatility-tolerant, growth-focused |

| Index Fund | 10% – 12% | Medium | Passive, cost-conscious long-term SIPs |

Dr.Satish Vadapalli

Research Analyst