There are no items in your cart

Add More

Add More

| Item Details | Price | ||

|---|---|---|---|

Indexation can save you a lot of tax on long-term capital gains. Learn how it works, when you can use it, and why recent rules have limited its scope.

03/07/2025

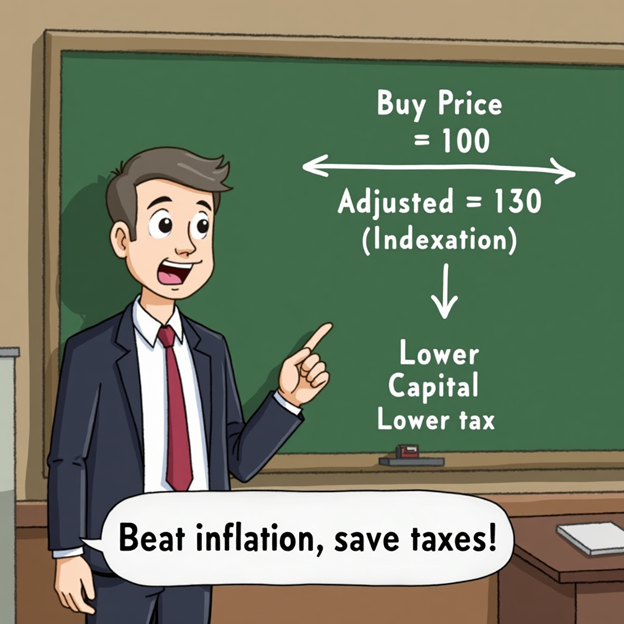

Indexation adjusts the purchase price of your investment for inflation — helping you reduce taxable capital gains. It used to be a powerful tool in debt mutual funds. But recent tax changes have made it applicable to only older investments and specific asset classes. Let’s understand how it works with numbers.

What Is Indexation?

Indexation uses the Cost Inflation Index (CII) published by the Income Tax Department. Indexed Cost Formula: Indexed Cost = Purchase Price × (CII of Sale Year / CII of Purchase Year) This helps lower the taxable gain, reducing the 20% LTCG tax on non-equity investments held for 3+ years.

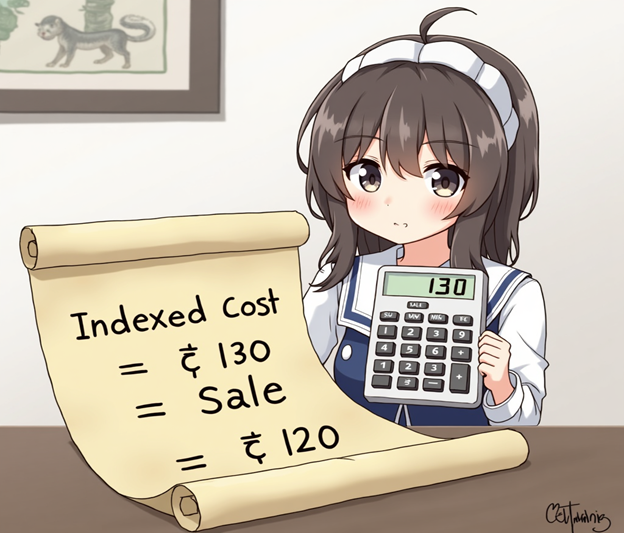

Real-Life Example: Ganesh’s Debt Fund Ganesh invested ₹2,00,000 in March 2019 (CII = 280) and redeemed in April 2023 (CII = 331).

Indexed Cost = ₹2,00,000 × (331 / 280) = ₹2,36,428

Redemption Value = ₹2,80,000

Taxable Gain = ₹2,80,000 – ₹2,36,428 = ₹43,572Without indexation, the tax would’ve been ₹16,000.

👉 Saved ₹7,286 due to indexation. When Can You Use Indexation?

✅ Only for investments before April 1, 2023, in:

Conclusion

Indexation helps beat inflation in taxes — but it’s now limited to legacy investments. Going forward, investors must plan keeping slab taxation in mind.

If you have older debt fund investments, hold them till 3 years to enjoy indexation. For new investments, assess if the slab rate still justifies debt mutual fund exposure.

Summary Table: Indexation Snapshot

| Investment Type | Eligible for Indexation | Conditions |

| Pre-April 2023 Debt MF | ✅ Yes | Held > 3 years |

| Post-April 2023 Debt MF | ❌ No | Taxed as per slab |

| Equity Mutual Funds | ❌ No | Flat 10% LTCG post 1 year |

| Gold/International FoFs | ✅ Yes (pre-Apr 2023) | Held > 3 years |

Dr. Satish Vadapalli

Research Analyst