There are no items in your cart

Add More

Add More

| Item Details | Price | ||

|---|---|---|---|

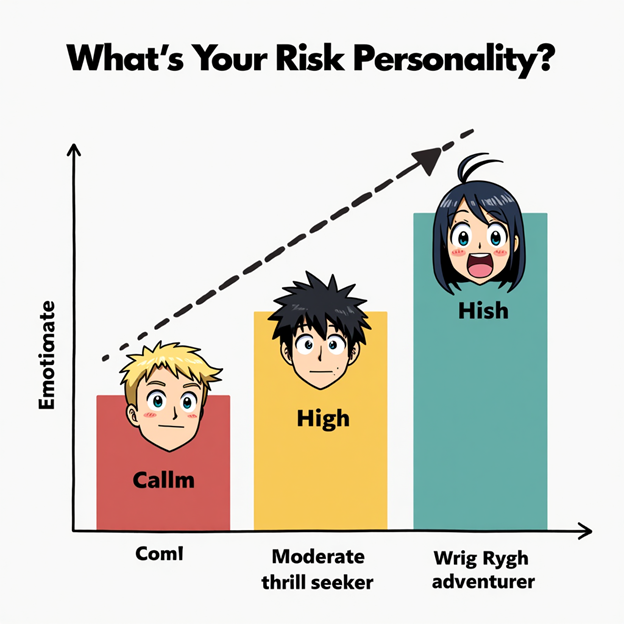

Your risk profile is the foundation of smart investing. Learn how to identify your personal risk appetite and match it with the right investment strategy for better outcomes.

11/06/2025

"Investing isn't one-size-fits-all. What suits your friend might rattle your nerves. That’s why knowing your risk profile — your ability and willingness to handle investment ups and downs — is the first step toward a successful investing journey.

From age and income to financial goals and emotions, multiple factors shape your risk-taking capacity. In this blog, we'll show you how to identify your risk profile, with a relatable example and a handy classification table.

What Is a Risk Profile?

Your risk profile is the combination of:

A mismatch between these can lead to panic, poor decisions, or underperformance. Key Factors to Assess Your Risk Profile

How to Know Your Risk Profile?

✅ Use SEBI-compliant risk profiling tools (available via mutual fund advisors or online) 💡 Answer questions on:

Conclusion :

Understanding your risk profile is the GPS of investing. It keeps you on track and prevents panic exits. Before chasing returns, align your investments with your risk tolerance.

Summary Table: Risk Profile vs Suitable Funds

| Risk Profile | Key Traits | Suitable Fund Types | 5-Year Return Range | Reaction in Volatile Markets |

| Conservative | Low income surplus, short-term goals, cautious | Liquid, Short-Term Debt, Conservative Hybrid | 5% – 8% | Prefers capital protection |

| Moderate | Balanced goals, some market experience | BAFs, Aggressive Hybrid, Large Cap Equity | 8% – 11% | Can tolerate short-term losses |

| Aggressive | High surplus, long-term goals, high market trust | Flexi Cap, Small Cap, Equity ETFs | 12% – 14% | Sees volatility as opportunity |

Dr. Satish Vadapalli

Research Analyst