There are no items in your cart

Add More

Add More

| Item Details | Price | ||

|---|---|---|---|

Heard about mutual funds but not sure what happens after you invest? You're not alone. happens Most people know that mutual funds are “a basket of investments,” but what really behind the scenes?

In this blog, we break down how mutual funds work — who manages your money, how returns are generated, how risks are handled, and what you need to know before investing. Whether you're new or brushing up, this guide will make mutual funds crystal clear with a real-life story you’ll relate to.

04/06/2025

A mutual fund is an investment vehicle where money from many investors is pooled together and professionally managed. This pooled money is then invested in assets like stocks, bonds, gold, or a mix of these, depending on the fund’s objective.

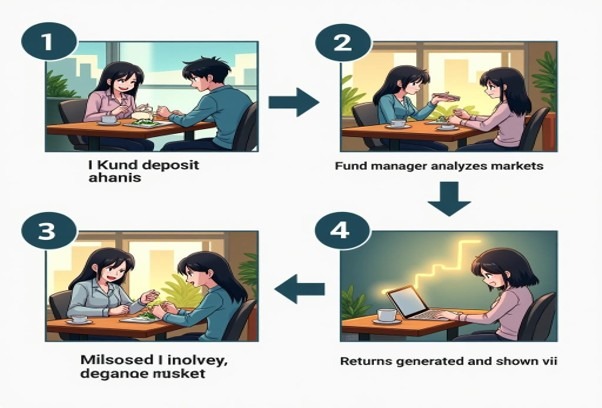

Here’s how it works in 5 simple steps:

1. You Invest: You buy units of a mutual fund, much like buying shares of a company.

2. Pooling Money: Your money is combined with that of thousands of others.

3. Fund Manager Invests: A professional fund manager uses this pool to buy a diversified portfolio of securities.

4. Returns Are Shared: If the portfolio gains, the value of each unit (called NAV) increases. If it drops, NAV falls.

5. Exit Anytime: In open-ended funds, you can redeem your units at current NAV. Mutual funds can be actively managed (where a manager tries to beat the market) or passively managed (like index funds, which simply track a market index).

Real-Life Example:

Priya & Rohan

• Rohan faced concentration risk and emotional decisions.

Rohan, a stock enthusiast, tries to build his own portfolio by picking 5 stocks with high returns. He checks charts daily and follows financial news religiously.

• Priya, a working professional with no time for markets, chooses a Balanced Mutual Fund. Over 3 years:

• Rohan sees wild ups and downs — sometimes 20% gain, other times 15% loss.

• Priya’s mutual fund delivers a steady 10% CAGR with lower volatility.

Why? Because Priya’s mutual fund was diversified and actively managed, while

Why Investors Prefer Mutual Funds

Professional Management – Experts make buy/sell decisions

Diversification – Reduces risk by spreading across sectors

Liquidity – Easy to buy or redeem (in open-ended funds)

Affordable – Start with as low as ₹500/month via SIP

Variety of Options – Equity, Debt, Hybrid, Index, and more But remember, returns are market-linked, and past performance doesn’t guarantee future gains

Conclusion

money, trust an expert to navigate markets, and enjoy the ride with minimal stress. Whether you’re aiming for Mutual funds are like hiring a skilled driver for your financial journey. You pool your long-term growth, steady income, or wealth preservation — there’s a mutual fund for every goal.

New to investing? Start with a simple SIP in a mutual fund aligned to your goals and risk profile. Let your money grow while you focus on life.

| Step | What Happens | Key Benefit |

|---|---|---|

| You Invest | Buy units of a mutual fund | Easy entry, even with small amounts. |

| Pooling of Funds | Combined with other investors' money | Access to large scale investing |

| Fund Manager Invests | Buys diversified portfolio based on scheme type | Expert decision-making |

| NAV Reflects Value | Daily value of your units changes with market performance | Transparent returns |

| You Redeem | In open-ended funds, exit at current NAV | High liquidity, redeem anytime |

Dr. Satish Vadapalli

Research Analyst