There are no items in your cart

Add More

Add More

| Item Details | Price | ||

|---|---|---|---|

Mutual fund dividends are no longer tax-free. Understand how they’re taxed in your hands and when to prefer Growth vs. IDCW options.

05/07/2025

Remember when mutual fund dividends used to be tax-free? Those days are gone. Since April 2020, dividends are taxable in the hands of the investor — just like salary or interest income.

In this blog, we explain how mutual fund dividends are taxed today, how they affect your returns, and whether you should still opt for them — using a relatable example.

What Changed?

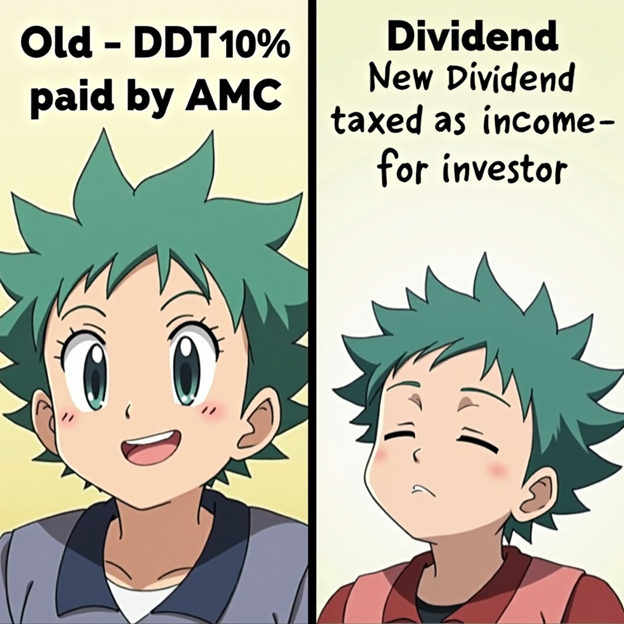

Before 2020: Dividends were tax-free in your hands, but the fund paid Dividend Distribution Tax (DDT). After 2020: No DDT. Instead, you pay tax on dividends as per your income tax slab.

✅ New Dividend Rules

Dividends feel nice, but the tax hit can silently eat into returns. For most investors, Growth is now the smarter choice.

Review your mutual fund schemes. If you’re in a higher tax bracket, consider switching to Growth to let compounding do its job.

Summary Table: Dividend Taxation Post-2020

| Category | Taxation Rule |

| Dividend Tax | Taxed as per income slab |

| TDS Threshold | 10% if dividends > ₹5,000/year |

| Growth Option | Tax only on redemption (LTCG/STCG rules) |

| IDCW Option | Taxed on payout, less efficient |

| Ideal For | Low-income or income-seeking investors |

VS FINTECH

A California-based travel writer, lover of food, oceans, and nature.