There are no items in your cart

Add More

Add More

| Item Details | Price | ||

|---|---|---|---|

Introduction

Not everyone needs the same mutual fund. A ₹30,000/month earner and a ₹2,00,000/month earner will likely have different priorities, risk appetites, and timelines. Matching your fund choice with your income bracket helps you align your goals, liquidity needs, and risk exposure.

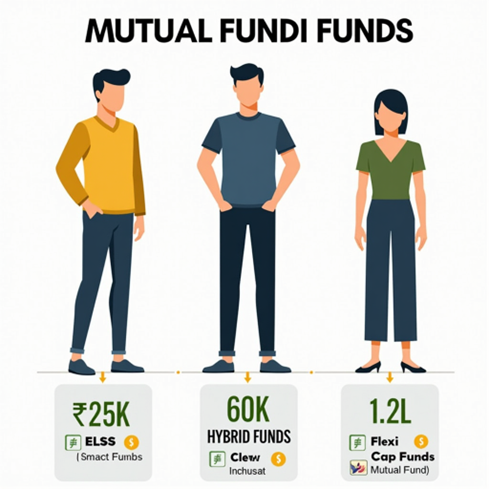

Let’s explore how mutual fund selection can vary across income levels — with a story of three friends: Neha, Rakesh, and Abhinav.

19/06/2025

Low Income (₹20,000 – ₹50,000/month)

Fund Choice: Focus on Liquid Funds and Short Duration Debt Funds for emergencies, and Conservative Hybrid Funds for small SIPs.

Goal: Build savings cushion + SIP discipline.

These options offer low risk and help form financial habits.

Middle Income (₹50,000 – ₹1,50,000/month)

Fund Choice: Begin SIPs in Flexi Cap, Large & Mid Cap, and Aggressive Hybrid Funds.

Goal: Combine long-term wealth creation with moderate volatility.

Great balance of growth and diversification.

High Income (₹1,50,000+/month)

Fund Choice: Add Mid/Small Cap, International Funds, and Thematic Funds for alpha generation.

Goal: Maximize returns, optimize tax, and diversify globally.

Suitable for investors with higher surplus and long-term view.

Real-Life Example: Neha, Rakesh, and Abhinav

| Income Bracket | Fund Types Preferred | Risk Level | Primary Goal |

|---|---|---|---|

| Low (₹20K-₹50K) | Liquid, Short-Term Debt, Conservative Hybrid | Low | Build safety net + SIP habit |

| Middle (₹50K-₹1.5L) | Flexi Cap, Large & Mid Cap, Aggressive Hybrid | Medium | Balanced growth |

| High (₹1.5L+) | Mid/Small Cap, International, Thematic, Tax Savers (ELSS) | High | Alpha generation + diversification |

Conclusion

Mutual funds aren’t one-size-fits-all. Your income affects your ability to take risk, invest more, and stay consistent. Match your funds to your bracket and scale up wisely as income grows.

Start where you are — even a ₹500 SIP in the right fund can set the tone for a disciplined financial journey. Assess your income, pick the right mix, and grow step by step.

Summary Table: Fund Choice by Income Bracket

| Income Bracket | Avg. Return (CAGR) | Avg. Risk (Volatility) | Avg. Investor Behaviour |

|---|---|---|---|

| Low (₹20K-₹50K) | 5% - 7% | Low | Conservative, consistent savers |

| Middle (₹50K-₹1.5L) | 9% - 11% | Medium | SIP-focused, moderate volatility |

| High (₹1.5L+) | 11% - 14% | High | Aggressive, multi-fund allocation |

Dr. Satish Vadapalli

Research Analyst