There are no items in your cart

Add More

Add More

| Item Details | Price | ||

|---|---|---|---|

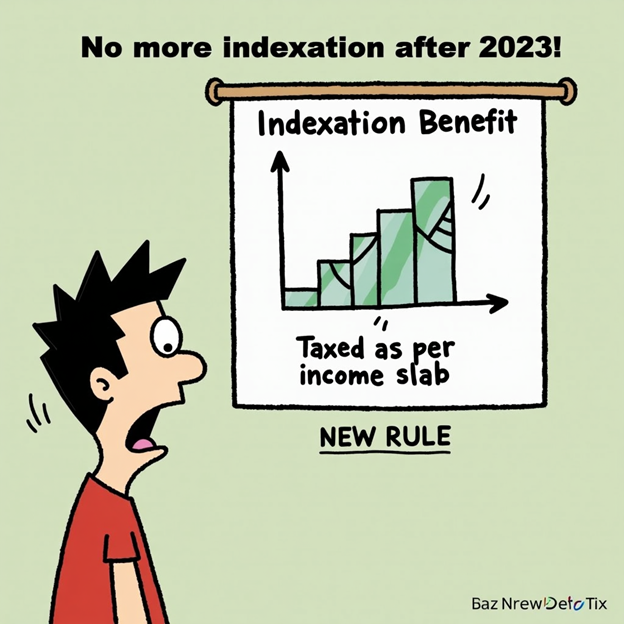

Major tax changes have hit debt mutual funds in 2023. Learn what changed, what indexation benefits you’ve lost, and how it affects your future returns.

02/07/2025

Until recently, long-term investors in debt funds enjoyed indexation benefits — a smart way to reduce tax on inflation-adjusted returns. But that changed in April 2023, when the tax rules were overhauled. Here's what you need to know if you invest in debt, gold, or international funds.

What Changed in April 2023?

The 2023 rule change narrows the tax edge of debt mutual funds — but they still offer flexibility, diversification, and better post-tax returns than some bank options (especially for low-slab investors).

Review your debt fund portfolio — and reallocate smartly based on your income tax slab and time horizon.

Summary Table: Debt Fund Taxation – Before & After

| Investment Date | Holding Period | Tax Treatment | Indexation Available |

| Before 1 April 2023 | > 3 years | 20% LTCG with indexation | ✅ Yes |

| After 1 April 2023 | Any duration | Taxed as per income slab | ❌ No |

Dr. Satish Vadapalli

Research Analyst